Home value depreciation calculator

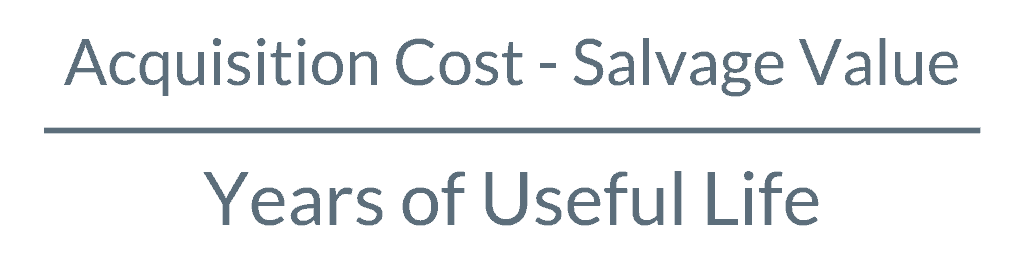

Percentage Depreciation Calculator Asset Value. The straight line calculation as the name suggests is a straight line drop in asset value.

Depreciation Formula Calculate Depreciation Expense

Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000.

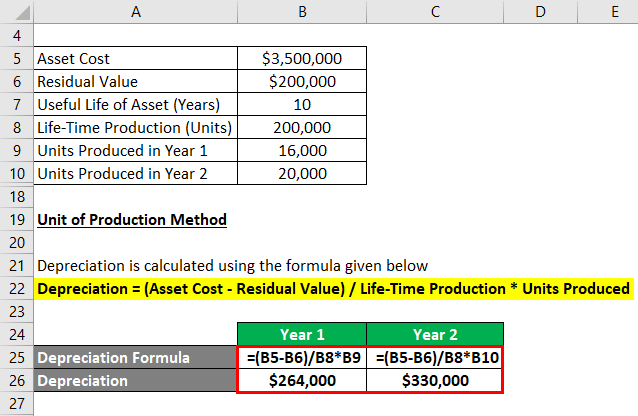

. The four most widely used depreciation formulaes are as listed below. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. Using the above example your cause in the housethe.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. For example if you put down 20000 on a 100000 home youve made a 20 down. The depreciation of an asset is spread evenly across the life.

Depreciation Calculator Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as The gradual reduction in value of an asset. Most often down payments are calculated as a percentage of the purchase price of the home. Now that you know the basics of the property and the homes value you should also assess your origin in the place.

Understanding your homes worth allows you to. Check out the percentage increase of your home value with this calculator. Calculate the average annual percentage rate of appreciation.

Straight Line Depreciation Method. With this in mind at the end of the next year the depreciation value is 900. Your basis in the land would be 11000.

The next again year the depreciation value is 810 and so on. Subtract the fair market value of the land from the cost basis of the rental home because land is not subject to depreciation. The value of the home after n years A P 1 R100 n Lets suppose that.

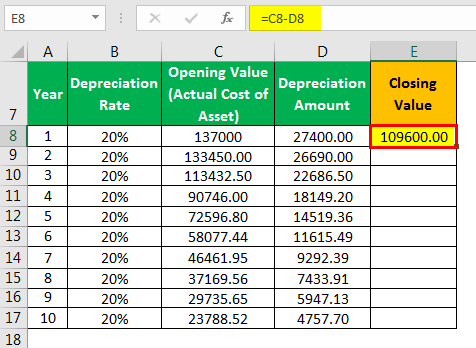

The Home Value Appreciation Calculator computes annual appreciation rate of your home using homes purchase price and date and sales price and date. Total Depreciation - The total amount of depreciation based upon the difference. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

For example if you purchased a rental home for 270000. The rate is positive when sales. Enter the original purchase price of your home and current estimated value to find out the the Annual Home.

Knowing the estimated value of your own home helps you price your home for sale as a precursor to an official home appraisal. Depreciation asset cost salvage value useful life of asset. Cap Rate is a simple formula that helps investors work out.

The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation. Also includes a specialized real estate property calculator. Ad Calculate Your Homes Estimated Market Valuation by Comparing the 5 Top Estimates Now.

A 250000 P 200000 n 5. Quickly assess the After-Repair Value of a property with our user friendly ARV Calculator.

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Straight Line Depreciation Calculator And Definition Retipster

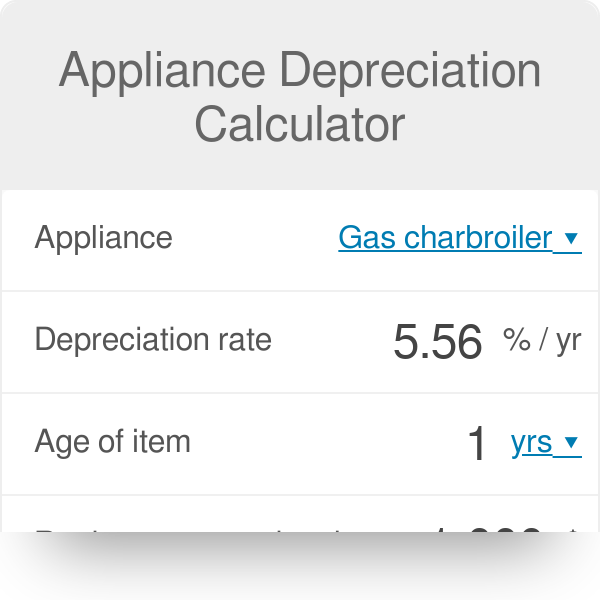

Appliance Depreciation Calculator

How To Calculate Depreciation On Rental Property

Depreciation Calculator Depreciation Of An Asset Car Property

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

How To Use Rental Property Depreciation To Your Advantage

Straight Line Depreciation Calculator Double Entry Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro